The financial sector in Pakistan is rapidly developing and the insurance sector indicates a remarkable growth potential. Securities and Exchange Commission of Pakistan (SECP), highest financial regulatory of the country, has declared thrilling job prospects in the field of insurance to experienced candidates. This guide has all the information you require in regard to the 2025 Joint Director roles of the Insurance Division within the SECP.

The Pakistani insurance market is undergoing a great boom as gross written premiums increased with only 2024 growing by PKR 265 billion to PKR 311 billion. Such rise gives regulatory positions at SECP especially interesting to professionals who want to influence the future of Pakistani financial market.

Position Overview: Joint Director Insurance Division

The Securities and Exchange Commission of Pakistan is inviting applications for two Joint Director posts in the Insurance Division, Islamabad on regular basis. These are important potential career steps forward to chartered accountants who are well experienced in financial services regulation and expertise in insurance field.

Key Position Details

Position Title: Joint Director (Insurance Division)

Number of Positions: 2

Location: Islamabad, Pakistan

Employment Type: Contractual (3 years with potential for permanent employment)

Application Deadline: August 1, 2025

Age Limit: Maximum 45 years on application submission date

Comprehensive Qualification Requirements

Educational Qualifications

The main educational qualification that is necessary in this job is a Chartered Accountant (CA). This is a strict demand so that the candidates have the basics in financial expertise able to deal with regulatory complexities in the insurance industry in Pakistan.

Professional Experience Requirements

Candidates must demonstrate a minimum of 10 years of post-qualification experience, specifically structured as follows:

- Big Four Audit Firm Experience: Minimum 4 years with recognized international audit firms (Deloitte, EY, KPMG, or PwC)

- Financial Sector Regulator Experience: Minimum 3 years working with financial sector regulatory authorities

Technical Knowledge Requirements

The successful candidate must possess in-depth understanding of:

- Insurance Laws and Regulations: Comprehensive knowledge of Pakistan’s insurance regulatory framework

- Financial Reporting Standards: Expertise in International Financial Reporting Standards for Insurance (IFRS-17)

- Risk Management: Current solvency and risk-based capital regime requirements

- Regulatory Compliance: Understanding of regulatory supervision and enforcement mechanisms

Company Background: Securities and Exchange Commission of Pakistan

About SECP

The SEC of Pakistan is the highest regulator body in the corporate sector of Pakistan, in the corporate capital market and Pakistan in the financial institution. The commission was established in year 1997 under the SECP Act 1997 and is involved in ensuring financial stability and investor protection.

SECP’s Core Functions

- Corporate Sector Regulation: Oversight of company registration, compliance, and corporate governance

- Capital Market Supervision: Regulation of stock exchanges, securities brokers, and investment advisors

- Insurance Industry Oversight: Supervision of insurance companies and takaful operators

- Non-Banking Finance Companies: Regulation of NBFCs and private pension schemes

Insurance Division Role

The Insurance Division within SECP is responsible for:

- Licensing and supervision of insurance companies

- Ensuring compliance with solvency requirements

- Consumer protection in insurance services

- Market development and product innovation oversight

Salary Structure and Compensation Package

Salary Scale for Joint Director Positions

| Career Level | Monthly Salary (PKR) | Annual Salary (PKR) | Benefits Package |

|---|---|---|---|

| Entry Level | 325,000 – 400,000 | 3,900,000 – 4,800,000 | Basic + Medical + Transport |

| Mid-Level | 400,000 – 500,000 | 4,800,000 – 6,000,000 | Enhanced Benefits + Performance Bonus |

| Senior Level | 500,000 – 600,000 | 6,000,000 – 7,200,000 | Executive Benefits + Retirement Fund |

Note: Salary ranges are based on industry standards and may vary based on qualifications and experience

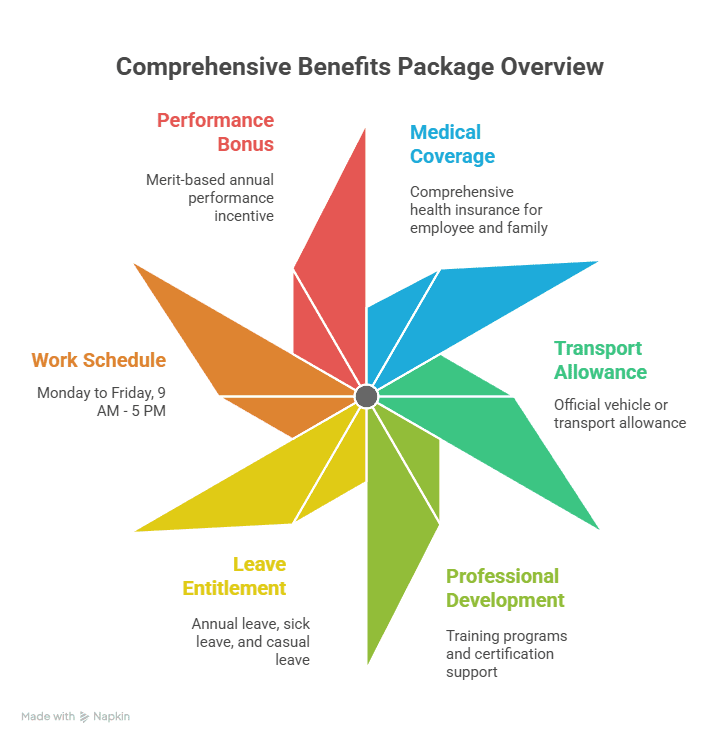

Additional Benefits and Work Conditions

| Benefit Category | Details | Value/Coverage |

|---|---|---|

| Medical Coverage | Comprehensive health insurance for employee and family | Up to PKR 2,000,000 annually |

| Transport Allowance | Official vehicle or transport allowance | PKR 50,000 – 80,000 monthly |

| Professional Development | Training programs and certification support | PKR 200,000 annually |

| Leave Entitlement | Annual leave, sick leave, and casual leave | 42 days annually |

| Work Schedule | Monday to Friday, 9 AM – 5 PM | 40 hours per week |

| Performance Bonus | Merit-based annual performance incentive | Up to 3 months’ salary |

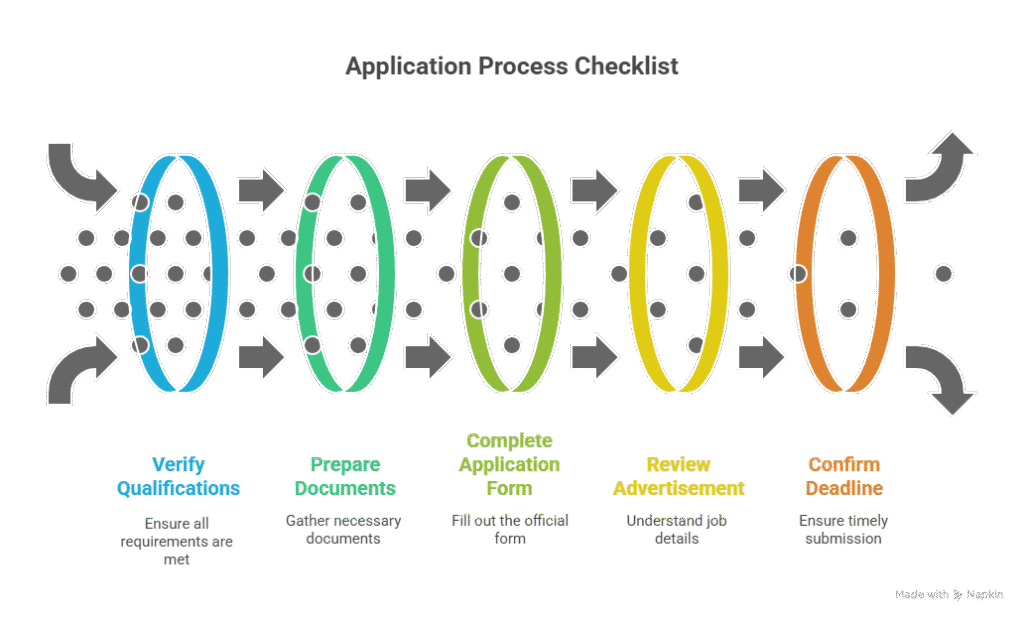

Application Process and Requirements

Step-by-Step Application Guide

- Visit Official Website: Access the SECP careers portal at www.secp.gov.pk/careers

- Review Complete Advertisement: Download and thoroughly review the complete job advertisement for detailed requirements

- Prepare Required Documents:

- Updated CV/Resume

- Educational certificates and transcripts

- Professional qualification certificates

- Experience certificates from previous employers

- CNIC copy

- Domicile certificate

- Recent passport-size photographs

- Complete Application Form: Fill out the official SECP job application form available on the website

- Submit Application: Applications must be submitted within 15 days of the advertisement publication date

Contact Information for Queries

Deputy Director – HRD

Phone: +92 51 919 5444

Email: Available through official website contact form

Address: NIC Building, 63 Jinnah Avenue, Blue Area, Islamabad

Special Preferences and Diversity Initiatives

SECP actively promotes diversity and inclusion in its workforce. The commission gives preference to:

- Female candidates meeting the specified criteria

- Candidates from underrepresented regions including:

- Balochistan

- Ex-FATA districts

- Gilgit-Baltistan

- Azad Jammu and Kashmir (AJK)

Career Growth and Development Opportunities

Professional Development Programs

SECP invests significantly in employee development through:

- Training Programs: Regular workshops on regulatory updates and industry best practices

- Professional Certifications: Support for obtaining additional professional qualifications

- International Exposure: Opportunities to attend international conferences and training programs

- Leadership Development: Structured programs for management skill enhancement

Career Progression Pathways

The Joint Director position offers excellent advancement opportunities:

- Senior Joint Director: Next level promotion within 3-5 years

- Deputy Director: Advanced management role with broader responsibilities

- Director: Senior leadership position overseeing multiple divisions

- Executive Director: Top-tier management role with strategic decision-making authority

Industry Context and Market Dynamics

Pakistan Insurance Sector Growth

The Pakistani insurance industry demonstrates robust growth potential:

- Market Size: Expected to reach US$11.62 billion by 2025

- Growth Rate: Consistent annual growth of 15-20%

- Life Insurance Dominance: 85.2% market share in overall insurance sector

- Regulatory Focus: Increasing emphasis on consumer protection and market development

Regulatory Challenges and Opportunities

The insurance sector faces several key challenges that Joint Directors will help address:

- Digital Transformation: Implementing technology-driven regulatory solutions

- Consumer Protection: Strengthening policyholder rights and complaint mechanisms

- Market Development: Expanding insurance penetration from current 0.7% to global averages

- Risk Management: Implementing sophisticated risk assessment frameworks

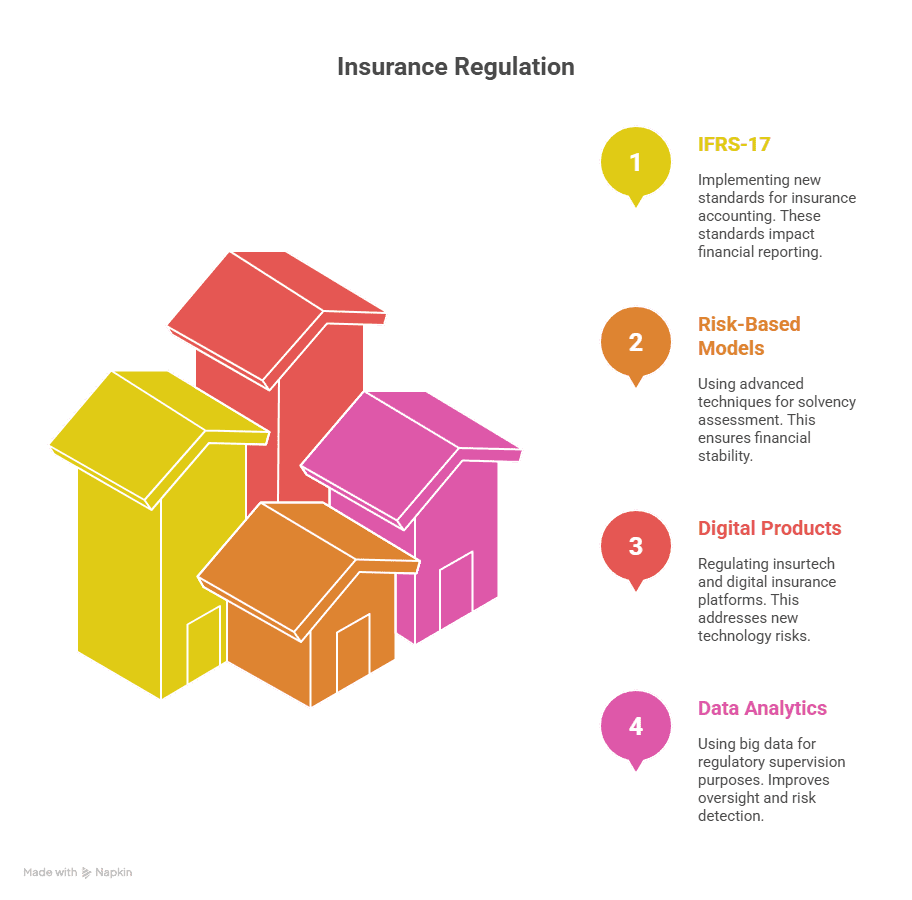

Skills Development and Training Requirements

Technical Skills Enhancement

Successful candidates should be prepared to develop expertise in:

- IFRS-17 Implementation: New insurance accounting standards

- Risk-Based Capital Models: Advanced solvency assessment techniques

- Digital Insurance Products: Regulation of insurtech and digital platforms

- Data Analytics: Using big data for regulatory supervision

Leadership and Management Skills

The role requires strong leadership capabilities including:

- Team Management: Leading diverse teams of regulatory professionals

- Stakeholder Engagement: Interfacing with industry representatives and government officials

- Strategic Planning: Contributing to long-term regulatory strategy development

- Crisis Management: Handling regulatory emergencies and market disruptions

Application Tips and Best Practices

Crafting a Competitive Application

To maximize your chances of selection:

- Highlight Relevant Experience: Emphasize specific achievements in insurance regulation or financial services

- Demonstrate Leadership: Provide examples of successful team leadership and project management

- Show Regulatory Knowledge: Detail your understanding of current regulatory frameworks

- Quantify Achievements: Use specific metrics to demonstrate your impact in previous roles

Interview Preparation

The selection process includes a multi-tier interview process covering:

- Technical Assessment: Insurance regulations and financial reporting standards

- Leadership Evaluation: Management experience and decision-making capabilities

- Strategic Thinking: Understanding of regulatory objectives and market dynamics

- Communication Skills: Ability to articulate complex regulatory concepts clearly

Work Environment and Culture

SECP’s Organizational Culture

SECP fosters a dynamic work environment characterized by:

- Integrity: Highest ethical standards in all professional activities

- Innovation: Encouraging creative solutions to regulatory challenges

- Collaboration: Teamwork across departments and with industry stakeholders

- Excellence: Commitment to delivering high-quality regulatory services

Work-Life Balance

The commission recognizes the importance of work-life balance through:

- Flexible Working Arrangements: Options for remote work when appropriate

- Professional Development Time: Allocated hours for training and skill development

- Family Support: Family-friendly policies and support systems

- Health and Wellness: Comprehensive health coverage and wellness programs

Future Prospects and Strategic Importance

Strategic Role in Financial Sector Development

Joint Directors in the Insurance Division play a crucial role in:

- Policy Development: Contributing to regulatory policy formulation

- Market Oversight: Ensuring fair and efficient insurance markets

- Innovation Support: Facilitating technological advancement in insurance

- International Cooperation: Representing Pakistan in international regulatory forums

Long-term Career Impact

This position offers significant long-term career benefits:

- Regulatory Expertise: Developing specialized knowledge in financial regulation

- Network Building: Establishing professional relationships across the financial sector

- Leadership Development: Gaining experience in senior management roles

- Public Service: Contributing to Pakistan’s economic development and financial stability

Conclusion and Next Steps

The SECP Insurance Division Joint Director vacancies are excellent prospects of proven chartered accountants who wish to develop their careers and grow as professionals in the field of financial development in Pakistan. As the insurance sector is growing and transforming considerably, the positions will provide an opportunity to influence regulatory systems that will affect millions of Pakistani citizens.

Competitive salaries and benefits, opportunities to grow professionally, and the ability to work on the cutting edge of financial regulation make those jobs highly desirable to the qualified professionals.

Application Checklist

Before submitting your application, ensure you have:

- Verified you meet all qualification requirements

- Prepared all required documents

- Completed the official application form

- Reviewed the complete job advertisement

- Confirmed application deadline compliance

Official Application Portal

To apply for these positions, visit the official SECP careers portal at www.secp.gov.pk/careers and follow the application instructions provided.

For additional information or clarification on any aspect of the application process, contact the Deputy Director – HRD at +92 51 919 5444.

The deadline to the application is August 1, 2025. Take this chance to be a part of leading financial regulator institution in Pakistan and become a part of development of insurance industry in this country.

Frequently Asked Questions

What qualifications are required?

Candidates must hold a Master’s or Bachelor’s degree (16 years of education) in Accounting, Finance, Insurance, or be credentialed as a CA, CMA, ACCA, or Actuary.

How much experience is needed?

At least 10 years relevant experience for Joint Director and 8 years for Additional Joint Director positions. CA articleship is acceptable.

What is the age limit for these roles?

Maximum age is typically 45 years, with reserved quotas for women, minorities, and under-represented regions like Balochistan and Gilgit-Baltistan.

What job roles are open in the Insurance Division?

Positions include Joint Director (Insurance) and Additional Joint Director (Insurance Supervision) under SECP’s Supervision Division in Islamabad.

How do I apply for these SECP jobs?

Apply online via the SECP Careers Portal. Follow the job listings, fill out the application form, and upload required documents as per the specified deadline.