The Balochistan Revenue Authority (BRA) has declared an outstanding internship opportunity in 2025, and it will be an opportunity of practical learning with the transforming Pakistan model of tax collection management. It is a wide-ranging program that needs an application with July 31, 2025 deadline of payment and is a major chance to develop their career as graduates keen to gain expertise in taxation, audit, information technology, and legal aspects in government service.

With the provincial revenue authorities in Pakistan still modernising their way of operations and increasing their digital facilities, there has never been a higher demand of professionals in tax administration. The internship program of the BRA is a tactical course between academic and practice and the opportunity to be directly exposed in revenue collecting practices and the carrying out of tax policy.

Position Overview and Career Pathways

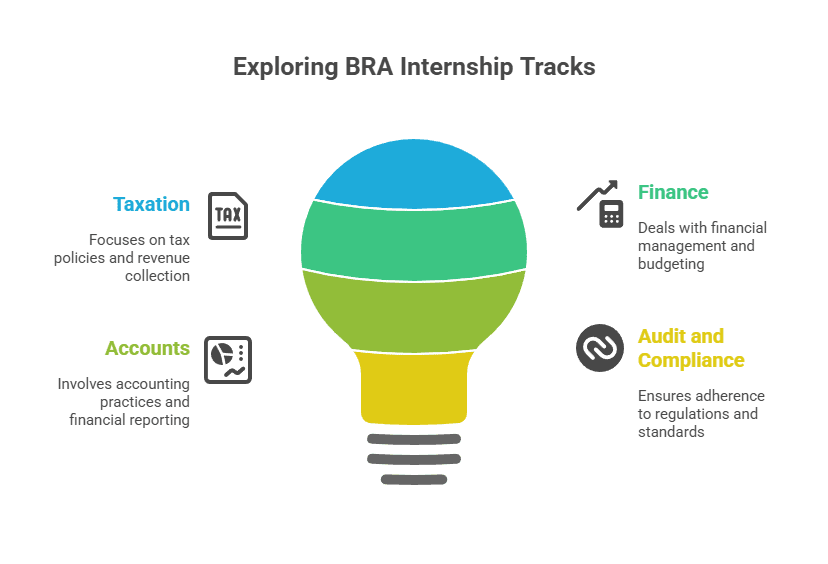

The Balochistan Revenue Authority internship covers four professional tracks, which build expertise around important facets in taxation management:

Taxation, Finance, and Accounts Track

The learning track aims to give in-depth knowledge of provincial taxation systems, tax revenue collection, and financial management systems within governmental systems. The interns will be exposed to sales tax on services, property tax collection and revenue forecasting techniques currently in use by BRA.

Audit and Compliance Track

The audit track focuses on risk assessment, compliance check-up, and investigative practices that are needed to secure tax system integrity. The participants will be taught the latest audit techniques, compliance systems and methods of assessing taxpayers under the direction of senior chartered accountants and audit experts.

Information Technology and Digital Innovation Track

Appreciating the important place of technology in contemporary tax management, this track trains the skills in tax software systems, digital filing platforms, and data analytical-based applications. Interns will get to use the technological support, such as e-filing systems and taxpayer databases, of BRA.

Legal and Regulatory Affairs Track

This dual thesis path is aimed at studying the rules of taxation, normative systems of lawfulness, and control models. Participants will get an understanding of tax laws, dispute settlement mechanisms, and documentation of law in provincial taxation.

Comprehensive Qualification Requirements

| Requirement Category | Specification | Additional Details |

|---|---|---|

| Educational Background | Bachelor’s/Master’s degree (16 years education) | Degree must be obtained within last 3 years |

| Age Limit | Under 28 years as of July 31, 2025 | Strict age verification required |

| Relevant Disciplines | Field-specific qualifications required | See detailed breakdown below |

| Academic Standing | Good academic record preferred | Transcripts required during application |

Detailed Academic Requirements by Track

Taxation/Finance/Accounts Track:

- Master’s or Bachelor’s degree (4 years) in Business Administration

- Finance, Economics, Commerce, or Statistics specialization

- Strong foundation in accounting principles and financial management

Audit Track:

- Chartered Accountant (CA) qualification

- ACCA (Association of Chartered Certified Accountants) certification

- Master’s/Bachelor’s degree (4 years) in Accounting

- Certificate in Accounting & Finance (CAF)

Information Technology Track:

- Master’s or Bachelor’s degree (4 years) in Computer Science

- Software Engineering, Computer Engineering, or Information Technology

- Programming and database management skills preferred

Legal Track:

- Master’s or Bachelor’s degree in Law (LLB/LLM)

- Understanding of taxation law and regulatory frameworks

- Legal research and documentation skills

Comprehensive Benefits and Compensation Package

| Benefit Category | Details | Value/Duration |

|---|---|---|

| Monthly Stipend | PKR 40,000 | 6 months (extendable) |

| Professional Development | Skills training and mentorship | Throughout program |

| Career Networking | Access to senior officials and industry professionals | Ongoing |

| Certificate of Completion | Official BRA internship certificate | Upon successful completion |

| Potential Employment | Preference in future BRA recruitment | Subject to performance |

The monthly stipend of PKR 40,000 is an attractive remuneration package in the Pakistani government internship market, especially in light of average internship wages which are PKR 15,000-25,000 in the market. BRA has decided on this investment in intern compensation because it is committed to attracting high pools of candidates and causing the program to be feasible in terms of finance.

About Balochistan Revenue Authority: Organizational Excellence

Balochistan Revenue Authority, formed in 2015 as an independent body corporate, serves as a new form of creating provincial tax administration in the country. Being the most significant revenue collection body in the Balochistan province, BRA has always been innovative in its implementation of tax policy and its ventures in digital transformation.

Key Organizational Achievements:

- Collected over PKR 30 billion in tax revenues in recent fiscal years

- Implemented comprehensive e-filing and digital payment systems

- Established robust taxpayer service centers across the province

- Developed sophisticated tax compliance monitoring systems

- Achieved significant improvements in voluntary tax compliance rates

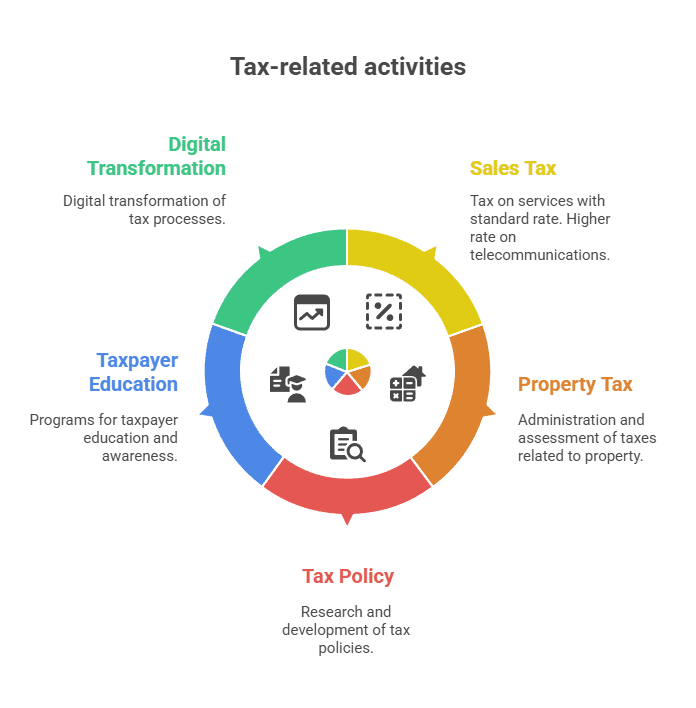

BRA’s Strategic Focus Areas:

- Sales Tax on Services (15% standard rate, 19.5% on telecommunications)

- Property tax administration and assessment

- Tax policy research and development

- Taxpayer education and awareness programs

- Digital transformation of tax processes

The organization’s commitment to professional development is evident in its structured approach to human resource management, with dedicated training programs for staff members and comprehensive career advancement opportunities.

Application Process and Selection Methodology

Step-by-Step Application Guide

1. Online Application Submission

- Visit the official BRA application portal: https://apply.bbra.com.pk

- Create user account with valid email address

- Complete comprehensive application form with accurate information

2. Document Preparation and Upload

- Degree certificates and transcripts (original copies required at interview)

- Computerized National Identity Card (CNIC)

- Two recent passport-size photographs

- Certificates of relevant work experience (if applicable)

- Character certificates from academic institutions

3. Application Review and Screening

- Initial eligibility verification based on educational and age criteria

- Document authenticity verification

- Academic performance assessment

4. Interview and Selection Process

- Shortlisted candidates notified via email/SMS

- Technical interviews conducted at BRA Head Office, Quetta

- Assessment of technical knowledge, communication skills, and professional aptitude

- Final selection based on overall performance and organizational fit

Important Application Guidelines:

- Separate applications required for each discipline

- Candidates may apply for only one discipline

- No travel allowance (TA/DA) provided for interview participation

- Original documents must be presented during interview

- Incomplete applications will not be considered

Professional Development and Learning Outcomes

The BRA internship program, by design, offers the elite in exposure to modern tax administration practices and acquiring the skills required during their career growth in the public service or the private sector are topics of this program.

Core Learning Objectives:

- Understanding of provincial tax legislation and regulatory frameworks

- Hands-on experience with tax administration software and digital platforms

- Development of analytical and problem-solving skills in tax-related scenarios

- Exposure to taxpayer service delivery and compliance management

- Professional communication and documentation skills enhancement

Mentorship and Guidance Structure:

- Direct supervision by experienced BRA professionals

- Regular feedback sessions and performance evaluations

- Access to senior management for career guidance

- Participation in departmental meetings and policy discussions

- Opportunity to contribute to ongoing projects and initiatives

Career Advancement Prospects

Successful completion of the BRA internship program opens diverse career pathways within both public and private sectors:

Government Sector Opportunities:>

- Direct recruitment preference in BRA permanent positions

- Eligibility for Federal Board of Revenue (FBR) positions

- Provincial government departments requiring tax expertise

- Audit and accounting positions in public sector organizations

Private Sector Applications:

- Tax consultancy firms and chartered accountancy practices

- Corporate tax departments in multinational companies

- Financial services and banking sector roles

- Legal firms specializing in tax law

Professional Development Outcomes:

- Enhanced understanding of Pakistan’s tax system

- Practical experience with government operations

- Professional network within tax administration community

- Valuable reference letters from senior government officials

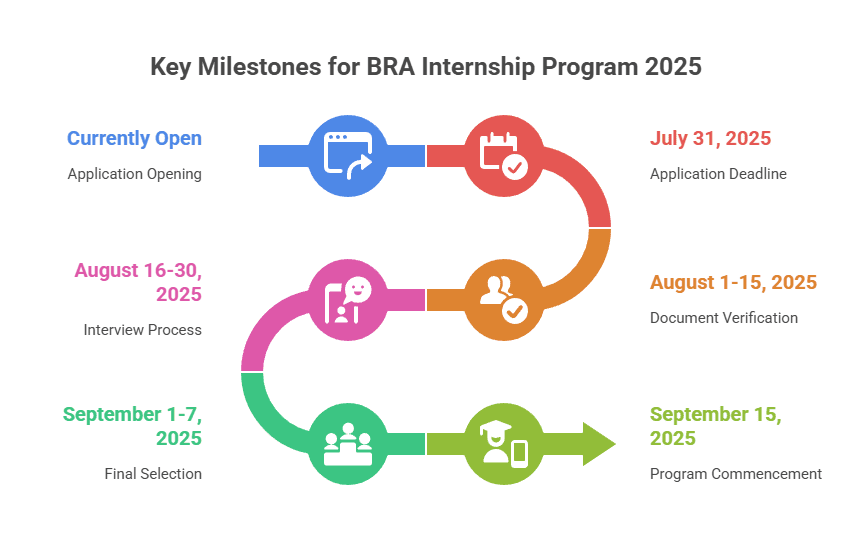

Application Deadline and Important Dates

| Milestone | Date | Action Required |

|---|---|---|

| Application Opening | Currently Open | Submit online application |

| Application Deadline | July 31, 2025 | Final submission date |

| Document Verification | August 1-15, 2025 | Candidates contacted individually |

| Interview Process | August 16-30, 2025 | Shortlisted candidates only |

| Final Selection | September 1-7, 2025 | Results announced |

| Program Commencement | September 15, 2025 | Orientation and onboarding |

Conclusion and Next Steps

The internship programme of the Balochistan Revenue Authority is a unique experience of young professionals to meet the modern challenges and environment of tax administration in Pakistan. This program forms a perfect background to working in the field of public service or in the taxation sector of the private sector as it comes with a competitive stipend of PKR 40,000 per month, extensive professional development opportunities, and direct insight into the practice of modern tax administration.

For interested candidates, the recommended next steps include:

- Immediate Action: Visit https://apply.bbra.com.pk to begin the application process

- Document Preparation: Gather all required certificates and documentation

- Application Submission: Complete the online application before the July 31, 2025 deadline

- Interview Preparation: Prepare for technical questions related to your chosen discipline

- Professional Development: Begin researching current tax policies and BRA operations

Besides offering financial aid in learning, this extensive internship program also gives priceless networking chances and hands-on experience that will serve the participants in their future. Structured learning, mentorship and on-the-job experience make this program especially useful to graduates who want to enter into the tax administration industry in Pakistan.

Apply now at https://apply.bbra.com.pk before the July 31, 2025 deadline to secure your place in this prestigious program.

Frequently Asked Questions

Can I apply for multiple disciplines?

No, candidates must select one discipline and submit a separate application for each additional discipline they wish to consider.

Is there an application fee?

The advertisement does not mention any application fee requirement.

What happens if my performance is unsatisfactory?

BRA reserves the right to terminate internships based on unsatisfactory performance or other relevant circumstances.

Are there opportunities for permanent employment?

While not guaranteed, successful interns may receive preference in future BRA recruitment processes.